Do you qualify for legally avoid paying up to 90% of your back tax debt, and finally be free in Great Falls

A quick 15 minutes with our BBB A+ experts can show you right now

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving Great Falls, and All of Montana

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Say goodbye to your tax problems for good with the help of our highly experienced team in Great Falls

Highly Experienced Great Falls Tax Lawyer

Among the worst things you can do with IRS back tax debt is continue to fail it for decades at a time. The IRS loves to add on interest charges and additional penalties to the amount you owe, and will stop at nothing to collect that money.

They’re the greatest collection agency on earth, and we firmly believe that no one should have to face them by themselves.

For most people, having a government agency that is huge continuously harassing them with revenue officers and letters, notices is a horrible idea.

That’s why our Great Falls team is here to help you. You no longer need to face the Internal Revenue Service by yourself, and will have someone in your corner to help negotiate for you.

So if you owe the federal government, or the state of Montana, our dedicated law firm is here to make your own life simpler.

With only 15 minutes on the telephone with our specialists, you will learn what to do next, and exactly what you’ll qualify for.

Give our Montana team a call today!

Tax liens can become rather challenging if you are buying or selling your home or property. Let our Great Falls team help you

What is a tax lien?

A federal tax lien is a lien imposed by the government to legally claim against your assets if by any chance you don’t remunerate your tax dues. The lien cushions the claim of the authority to all your existing property, inclusive of financial, personal and real estate assets. It transforms it into a public record matter, when a lien is filed. Liens normally record the exact amount owed to IRS at the precise time that it is levied in a public file known as the Notice of Federal Tax Lien. The document notifies lenders the government has a right to confiscate your property at any particular time. Different credit reporting agencies conventionally acquire this particular info therefore tax liens ultimately reflect on your credit reports.

Federal tax liens can easily be prevented from being lodged by paying all your tax dues up and also before the IRS decide to impose a lien in your assets. Through establishing installment deals which sufficiently satisfy the demands of the IRS as not to file a lien, they can also be evaded. A federal tax lien can’t be filed if a citizen decided to prepare a streamlined or guaranteed payment accord. Such agreements require the taxpayer keep a balance of $10,000 or a figure less than that for the bonded installment accord and for the streamlined arrangement it that is, should be $25,000 or less. In a situation where the taxpayer owes more than $25, 000, a tax lien may be averted if he/she a streamlined accord. lays out tries their best to reduce that specific outstanding balance to exactly $25,000 or less and instead There are two methods of removing tax liens: withdrawal and release.

What do I have to do to get my tax lien removed?

Getting federal tax liens is like it never existed, when the IRS resort to revoking the lien. The lien is filled erroneously, lien withdrawals typically take place. In a case where the tax lien is erroneously filed, contact the IRS as soon as possible. The IRS agents will check your account in order to substantiate you have no tax arrears then take the measures that are crucial in removing the lien.

Releasing a federal or Montana state tax lien usually means that the imposed lien no longer constrains your assets. Promptly after lien releasing, the county records will instantly be brought up to date to demonstrate that’s has been released. Yet,the existence of a federal tax lien once will be displayed in your credit reports for 10 years. Liens are usually released within a month of clearing the outstanding tax arrears or upon establishing the guaranteed and streamlined deals.

What to Do Next

To sort elaborate lien dilemmas struck, for instance discharge,withdrawal,subrogation and subordination (Collection advisory group), Concluding basic lien issues, requesting or confirming a lien, releasing a lien (Central Lien operation), Guidance from organizations within IRS (Taxpayer Advocate service), Inquiring whether bankruptcy influenced your tax arrears (Centralized insolvency operation),don’t be unwilling to go to our offices to assist you in effectively removing your tax liens by settling your debts on program to avert the authorities from confiscating your property or alternatively you can give us a call and our Great Falls agents shall have the ability to help you navigate through any impending federal tax liens.

A seasoned law firm is your best shot of finally being free of tax debts that are back in Montana

Have you ever been fighting with your back tax debts for several years, and are eventually fed up with dealing with the IRS on your own?

Have they started sending letters and notices to your residence or business, demanding you pay interest charges and extra fees for the sum you owe?

If so, the best thing you can do is hire a reputable and experienced tax law firm to be by your side each step of the way. The great news is, our Great Falls company is the perfect candidate for the occupation, with an A+ company rating with all the BBB, tens of thousands of happy clients around the country (particularly in amazing Montana), and our own team of tax attorneys, CPAs and federally enrolled agents, all prepared to work on your case today.

The IRS is the biggest collection agency in the world, with a large number of billions and revenue officers of dollars set aside to pursue great, hard working folks like you for the money you owe. You should not have to face them by yourself. We don’t get intimidated around like ordinary citizens do, and can use our private contacts to negotiate the resolution that you need.

Using experienced Great Falls legal counsel on your own tax dilemmas is similar to having a specialist plumber come and fix your massively leaking water main.

Do your family, yourself as well as your future a favor right now, and let our Great Falls law firm help you with your back tax issues at once. Our team of specialists is standing by, prepared to help you today!

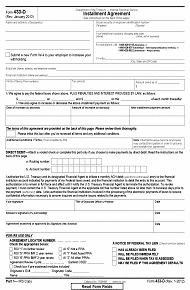

An Installment Agreement can spread your payments out over time, which means you don't have to pay

So long as the taxpayer pays their tax debt in full under this Agreement, they could reduce or eliminate the payment of interest and fees and prevent the payment of the fee that’s associated with creating the Agreement. Creating an IRS Installment Agreement requires that all necessary tax returns have been filed prior to applying for the Arrangement. The taxpayer cannot have some unreported income. If more than $50,00 in tax debts are owed, then the taxpayer may apply for a longer period to pay the debt. In some cases, a taxpayer may ask for a longer interval than 72 months to pay back a tax debt of $50,000 or less.

Benefits of an Installment Agreement

The agreement will result in certain important gains for the taxpayer. While an arrangement is in effect, enforced collection action will never be taken. When the taxpayer can count on paying a set payment each month rather than having to be worried about getting lump sum amounts on the tax debt, there will be more financial independence. The citizen will eliminate ongoing IRS penalties and interest. The Internal Revenue Service will help the citizen keep the agreement in force in the event the taxpayer defaults on a payment providing the IRS is notified instantly.

Obligations of the Installment Plan

Some duties include the Installment Agreement. When due, the minimum payment should be made. The income of the incomes of taxpayers that were joint or an individual citizen should be disclosed when applying for an Installment Agreement. In some instances, a financial statement must be provided. All future returns must be filed when due and all the taxes owed with these returns have to be paid when due. Taxpayers paying their tax debt under an Installment Agreement may be required to authorize direct debit of their checking account. This method of making monthly payments enable the taxpayer to request the lien notice be removed. However, the lien could be reinstated in the event the taxpayer defaults on the Installment Agreement.

The citizen and the Internal Revenue Service can negotiate an Installment Agreement. However, specific advice should be provided and any info might be subject to affirmation. For citizens a financial statement will be required.

How to Get Ready to Apply

While taxpayers can submit an application for an IRS Installment Agreement, there are a few precautions that must be contemplated. There are some condition which can make this a challenging endeavor, though the IRS attempts to make applying for an Installment Agreement a relatively easy process. Since many issues can be eliminated by an Installment Agreement with the Internal Revenue Service, it is essential to get it right the very first time that the application is made.

We are the BBB A+ rated law firm serving all of Great Falls and Montana, which could offer you skilled assistance. Our many years of experience working on behalf of taxpayers that have problems with the IRS qualifies us to ensure acceptance of your application for an Installment Agreement.

If you have failed to pay your taxes for several years, our Great Falls team is able to help you get back on track.

Have you forgotten to file your back tax returns for a number of years? We can help.

The W-2S and 1099 forms for every tax year are necessary when filing your back tax returns you receive. In the event you are eligible to credits and deductions; you will need to assemble any other supporting document that will prove your qualifications to the claim.

In case you have some lost tax document particularly within the last 10 years, then you should request a copy from IRS by simply filing form 4506-T. Form 4506-T is the tax return transcript. You should utilize the form to request for 1099S, W-2S which should provide support for your deductions. IRS will give you a transcript including the information that you are required to file your tax returns. The IRS may take up to 45 days to process this request.

Additionally, your back tax returns should be filed by you on the initial forms for that tax year. Begin by searching the IRS web site for them. Double check to make sure that you’re using the instructions related to the same tax year returns are filling for after you have collected all the applicable files. Tax laws are constantly changing and using the wrong instructions may require the filing process to be started by you once more. Finally, you should submit all the forms through the address to the IRS.

What to Do With Un-Filed Tax Returns

As you can, when you have any additional income tax for the preceding years, you must comprise as much payment. This way you’ll reduce interest charges accumulation. Unlike the tax fees which stop to collect once they are at the maximum, the monthly interests continue to accumulate until you’ve paid the tax. They’ll send you a notice of the precise quantity that you must pay as a penalty and interest rate, after the IRS has received your tax returns.

You’ll have to work with all the Internal Revenue Service in case you are incapable of paying your tax returns in full. Nonetheless, you should note that taxes that are back and the past due debts, can decrease your federal tax refund. Treasury offset application may use part or your whole federal returns to settle any unpaid national or state debt.

You must know the Department of Treasury’s of the Fiscal Service, the Agency of the Fiscal service or simply BFS – runs the counterbalance program from the treasury. It might use your complete tax refund or component to pay some debts which include parent support, delinquent student loans, and unemployment compensation debts. In case you have filed tax returns jointly with your partner you may be entitled to component or the entire counter.

The law prohibits IRS from using levies/liens in collecting individual duty payments that are common. But if you owe any common duty payment, IRS can cancel the obligation against tax refund due to you personally.

What You Should Do If You Have Back Tax Returns

You can consult with our BBB A+ rated Great Falls tax law company for help in case you haven’t filed your back tax returns for many years.|} Our team of experts in Montana is always ready to help you solve your issues and in addition they’re constantly prepared to answer your questions.

Avoid being conned by a Montana tax aid firm, and let our BBB A Rated team help you

Most people are law-abiding Great Falls citizens and they fear the threats of IRS actions. These businesses entice innocent individuals in their scams and commit even and consumer fraud larceny! There are many ways in which they fool people of their hard earned cash: by charging upfront nonrefundable payments without providing any guarantees, by misrepresenting future results, by posing as a service provider and selling the sensitive information of the consumers to other providers, by outright stealing from customers and so on. Thus, care should be exercised by you when you are trying to find a tax resolution firm for yourself.

What Scammy Companies can do

Not all Montana tax relief companies who guarantee to negotiate together with the IRS for you’re trustworthy. Hence, averting IRS tax relief scams is vitally significant since there are all those deceitful businesses out there. It is possible to avoid being taken advantage of, all you have to do would be to educate yourself in this aspect and to follow a couple of useful tips! A tax resolution firm that is authentic will constantly folow a mutually satisfactory financial arrangement wherein the payments may be made on a weekly, biweekly or monthly basis.

Secondly, it is wise to be somewhat careful when you are picking a particular tax resolution firm to work with. Chances are the business is fallacious should they promise you the desired results or state that you qualify for any IRS program without even going through a complete financial analysis of your present situation then. After all, without going through your complete fiscal analysis first, it is not possible for firms to pass such judgment. So, don’t fall for their sugar-coated promises and hunt for other businesses that are genuine instead.

How to find out about your tax relief firm

The internet is a storehouse of information, but you have to be cautious about using such advice. Do not just hire any haphazard business with promotional campaigns or great ads for handling your tax associated problems. In order to pick the right company, it is best to study about the same in the Better Business Bureau site and see their ratings or reviews. Consequently, doing your assignments and investing time in research is certainly a shrewd move here.

A website that has a good evaluation on BBB is unquestionably one that you can put your trust in. We’re a BBB A+ rated Great Falls business, we help individuals by relieving their IRS back tax debts. Our tax alternatives are reasonable, in order to make sure that your tax debts are eliminated, we don’t merely negotiate with the IRS on your own behalf, but rather develop a practical strategy first. We do all the hard work for you while you concentrate on other significant elements of your own life. Thanks to our vast experience and expertise in the field, you can rest assured your tax problems would be resolved quickly and efficiently when you turn for help to us.

Other Cities Around Great Falls We Serve

| Address | Great Falls Instant Tax Attorney9 3rd St N, Great Falls, MT 59401 |

|---|---|

| Phone | (406) 813-1777 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Great Falls We Serve | Belt, Black Eagle, Brady, Carter, Cascade, Choteau, Dutton, Fairfield, Floweree, Fort Benton, Fort Shaw, Geraldine, Geyser, Great Falls, Highwood, Loma, Malmstrom A F B, Monarch, Neihart, Power, Raynesford, Sand Coulee, Simms, Stockett, Sun River, Ulm, Vaughn |

| City Website | Great Falls Website |

| Wikipedia | Great Falls Wikipedia Page |